I used to have a Google AdSense "ad" here but the AdSense people at Google kept sending out homosexual oriented garbage so I deleted it. The jerks."

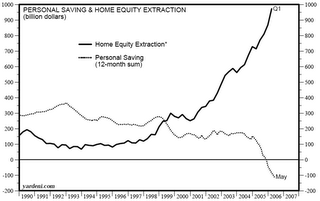

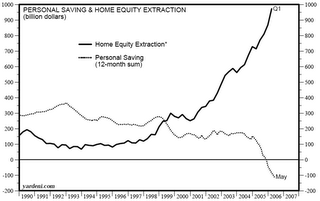

Personal Savings Rate - in the dumper

"Personal saving -- DPI less personal outlays -- was a negative $83.5 billion in July, compared with a negative $67.6 billion in June. Personal saving as a percentage of disposable personal income was a negative 0.9 percent in July, compared with a negative 0.7 percent in June." -- Urban Survival

Click HERE for the FULL Story

The great recession of 2007

MarketWatch.com reports that "The United States is headed for a recession that will be 'much nastier, deeper and more protracted' than the 2001 recession, says Nouriel Roubini, president of Roubini Global Economics and professor of economics at New York University."

He says that "Every housing indictor is in free fall. As the housing sector slumps, the job and income and wage losses in housing will percolate throughout the economy."

Beyond that ugly volcanic eruption of bad news, he notes that it gets worse, as "Consumers also face high energy prices, higher interest rates, stagnant wages, negative savings and high debt levels."

This housing bust is, in effect, the "straw that broke the camel's back", and he says that "This is the tipping point for the U.S. consumer and the effects will be ugly. Expect the great recession of 2007 to be much nastier, deeper and more protracted than the 2001 recession."

Click HERE for the FULL Story

America's Sick E-Con: A Picture Worth Thousand Cries For the Optimists

"Recession to Begin Within Six Months and Depression Prior to 2008Q2"

-- Jas Jain, Ph. D.

Americans have been led by a corrupt economic elite that has misled them into a self-destructive behavior for their own short-term gain.

Click HERE for the FULL Story

The Mother of all Economic Problems

All of the economic problems we face do have the same root cause (a “mother”). "This mother either caused the problem directly or took a relatively manageable or minor issue and turned it into a major economic problem. The mother of all economic problems is government."

Click HERE for the FULL Story

Russians Dump Dollar

MOSCOW -(Dow Jones)- Russians abandoned the dollar at an unprecedented rate in the first half of this year, the news agency RIA Novosti reported Central Bank deputy chairman Alexei Ulyukayev as saying Friday.

Ulyukayev told a press conference - to which foreign press weren't invited - that dollar assets held by the population had fallen by $5.1 billion in the first half of this year - three times the rate seen in the corresponding period in 2005.

Click HERE for the FULL Story

US housing slump fuels crash fears

'Things do seem to be getting worse very quickly. Freefall is a strong word, but I think it's the right one to use here,' said Paul Ashworth, chief US economist at Capital Economics.

Click HERE for the FULL Story

Three IT Warning Signs

From "Money and Markets":

"First, Phoenix Technology, the largest BIOS (Basic Integrated Operating System) software maker in the world has coughed up a huge hairball, warning that it would miss its quarterly expectations by a country mile. That sure got my attention because BIOS software is used to start up every computer in the world. When Phoenix, which has a 70% share of the BIOS software market, is having problems, it’s a giant red flag that something is very, very wrong in the PC world. Phoenix Technologies warned that its second-quarter sales would only hit $10 to $12 million, a far, far cry below its prior guidance of $24.5 million to $26.5 million. According to the company, “We have seen slower-than-expected Core System Software or BIOS sales ... as well as a change in the supply chain buying patterns of ODMs [original design manufacturers] due to a general inventory build-up in the PC market.” In other words, Phoenix’s business really stinks.

Bottom line: If PC makers are buying fewer BIOS systems, it means they’re making few computers. And that spells trouble for Intel.

Second, Hewlett-Packard, the second-largest computer maker in the world, announced on Thursday that it was going to close “several hundred properties.” Wow, that’s a lot of closures! And believe me, they’re definitely not doing this because business is booming.

Third, Dell’s business is still a wreck. The company is now going to simplify its pricing structure by reducing its promotions and rebates by 80%. The goal: Raising prices to boost its slumping profit margins.

Click HERE for the FULL story

The Warning Flags Are Everywhere

"The above recklessness has put the US economy in a precarious situation. Interest-rates are now rising all over the world and after a multi-month pause, I expect interest-rates to continue their upward trend. So far, the Federal Reserve has raised rates 17-times to 5.25% and the impact is already being felt on American real-estate. I'm afraid, the property industry in the US is falling into a serious recession. In June, new home sales fell to 1.49 million units, the lowest since November 2004 and down 18.1% from the record-high of 1.81 million units during January 2006. Furthermore, the supply of US-homes for sale has recently jumped to a multi-decade high. In summary, rising-interest rates are starting to bite into the real-estate boom and trouble may be on the horizon."

Click HERE for the FULL Story

Housing Crash is HERE

Housing crash puts sellers in debt crisisA THREE-BEDROOM brick-veneer house in St Clair sold for just $260,000 at the weekend - down about 42 per cent from its last sale at $450,000 in 2003 in a further sign of the depressed state of the Sydney property market.

Only one person bid on the house in the city's west. The mortgagee sale was forced after the owners could not meet the interest payments on the $405,000 they borrowed to buy the house at the peak of the market.

Auction clearance rates are hovering around 48 per cent since the recent interest rate rise, but plummeting property prices have meant many vendors are confronting negative equity, where they owe more on the property than it is worth.

Click HERE for the FULL Story

We're TOAST

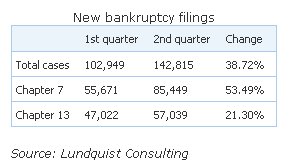

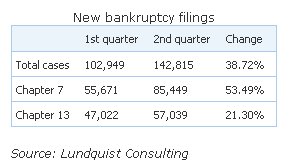

Consumer bankruptcy filings continue to increase, with Chapter 7 liquidation filings rising 54% in the second quarter compared to the previous three months.

Consumer bankruptcies had plunged following the passage of a tough new bankruptcy law last year. By the second quarter, however, the pace of filings had picked up to 2,200 to 2,300 new filings per business day, more than four times the level in November 2005 after the bankruptcy law went into effect, according to Chris Lundquist, founder of Lundquist Consulting, which tracks bankruptcy trends.

Individuals filed 85,449 Chapter 7 cases in the three months ended June 30 and 142,815 bankruptcy cases overall, a 39% increase from the previous quarter. (Most consumer bankruptcies are either Chapter 7s, which allow people to erase most of their unsecured debts, or Chapter 13s, which require that at least some of the debt be repaid over time.)

Click HERE for the FULL story

Dollar is Collapsing

This is not a healthy dollar!

Builder: Oversupply slump worst in 40 years

NEW YORK (CNNMoney.com) -- Homebuilder Toll Brothers said the current slump in residential construction is unlike any it has seen in 40 years as it became the latest to warn of a glut in new homes for sale and a slowdown in the closely watched real estate market.

The housing and homebuilding markets have helped drive the national economy during the past few years. Any downturns in these critical sectors could add to the problems of an already unsteady situation.

In a statement, company chairman Robert Toll warned there is a glut of supply of homes for sale in the market, as the building boom of recent years seems to be turning into a bust.

Click HERE for the FULL Story

Economic Madness

Here are some hard-core facts that you need to consider. Starting in 2000, the U.S. has created $1.5 trillion new dollars (M2), and has a cumulative trade deficit of $1.6 trillion. This totals $3.1 trillion on the negative side of the dollar equation. To say the least, this is bad monetary karma and will lead toward a very strong gold price.

From 1973 to 1981 the inflation rate in the U.S. averaged 9.2% per year ! The Fed raising interest rates during this time, on balance did nothing ! Why ? Because the money increases from prior years were already in the system…the horses were out of the barn. For most of this time gold went up, interest rates went up and inflation went up. Prior to this time the money supply (M2) from 1965 to 1974 increased 101%. This caused the inflation from 1973 to 1981. The Fed could not stop it. Gold went from $100 to $850.

Here is a reality check on the above mentioned $1.5 trillion created from the year 2000. First, I will refer to the U.S. money supply (M2) in 1980. It was $1.5 trillion. All the tangible wealth in the United States, every bridge, office building, home, car, television, plane, everything was created over 200 years with a money supply that ended up at $1.5 trillion. 200 years of blood, sweat and tears to create all the tangible wealth in the U.S. Our country in a bit more than four years has created the same amount of money! $1.5 trillion! This new money has not created anything near the tangible wealth of the first 200 year’s $1.5 trillion. This is currency depreciation on a grand scale.

This is economic madness.

Click HERE for the FULL article

Oil Production versus Price

In a nutshell... When prices go up dramatically, oil producers typically ramp up production to take advantage of it. This time however, despite huge price (not cost) increases, the oil producers are not growing production.

This is a concern!

Astounding Economic Fallout

At the ASPO conference a riveting presentation was delivered by Terence Ward, a writer (Searching for Hassan) who grew up in Iran and is currently a cross-cultural consultant for businesses, foundations, and governments in the Islamic World and the West. Ward believes that a US bombing attack on Tehran is nearly inevitable and that it will have devastating consequences for the region and for the world.

He began by reminding the audience that there is no clear proof of an Iranian nuclear weapons program, and that what the US and Israel have pointed to as evidence falls short of what would be needed to publicly justify pre-emptive military action. The central question hanging over the proposals and counter-proposals involving the US, Iran, the UN Security Council, and other interested parties including Russia and China, is this: What if both the US and Iranian presidents seek confrontation and war?

Click HERE for the Full Article

Gold, the M3, and Manipulations

"Why does the Fed no longer want to report the total quantity of dollars in circulation? They know what's coming - massive amounts of dollar creation to fund the worsening trade and federal government budget deficits."

Dennis Gartman, of the Institutionally- favored Gartman Letter, generally rubbishes these kinds of concerns. But nevertheless this past week, Gartman increased his portfolio exposure to gold to about half, depending on how you calculate it. He also bought back a position in Suncor Energy Inc. (SU), about as pure a bearish Middle East bet other than gold that I can see.

Click HERE for the FULL Story