The Coming Consumer Crunch

by Nilus MattiveWeiss Research, Inc.

When I moved to New York City to start my career on Wall Street, I quickly learned that the most popular sport in town wasn’t baseball, basketball, or football … it was full-contact shopping. My friends and co-workers whiled away their non-working hours hitting every boutique from Soho to Midtown, eating at fancy restaurants, and frequenting expensive bars. And their habits were dangerously contagious. Since I’ve moved down here to Florida, I realize that the New York lifestyle is a bit hyperbolic – most folks don’t happily fork over $10 for a beer.

Still, I think the behavior pattern holds true all across our fair land: A walk in the park is no longer as fun as a walk through the mall. Spending is now beyond the national pastime. It’s a nationwide pandemic. What makes this so worrisome is the fact that our economy relies on "Spend-Happy" consumers. Some people say consumer spending accounts for two-thirds of U.S. gross domestic product. But it’s actually getting closer to three-fourths of the economy.

Wall Street loves touting this statistic when Americans are borrowing, spending, and generally feeling good about the future. And indeed, just yesterday, the July consumer spending numbers came in – the strongest in nine months. Everyone cheered the news, proclaiming that the back-to-school season got off to a stellar start. But the real question is: How long can this last? Already, even though people keep on shopping, their faith in the future is dropping:

• The University of Michigan’s overall consumer sentiment index has plunged to 78.7 in the preliminary August reading vs. 84.7 in the final July result. That’s the lowest since last October, when Americans were still reeling from Hurricanes Katrina and Rita.

• The index reflecting current economic conditions also fell – to 100.8 from 103.5 in July. In other words, the survey respondents aren’t happy about things right now.

• Consumers don’t have much hope for the future, either – the economic outlook index dropped to 64.5 from 72.5.

Another major consumer survey, from the Conference Board, just came out three days ago. It painted a similar picture – Americans’ faith in the economy plunged to a nine-month low.

It’s easy to see what’s got everybody down: Conflicts and terrorism, rising gas prices, higher interest rates, signs that inflation is ramping up, as well as job-related worries. Plus, the latest home sales data has been downright awful.

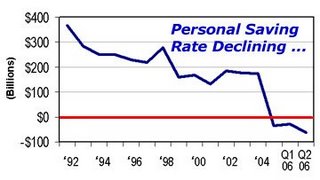

Despite all this, people are still spending (for now). That begs the question: Where are they getting the money? The last time American consumers spent more than they earned was during the Great Depression. Now, they ’re doing it again!! The U.S. Commerce Department's Bureau of Economic Analysis (BEA) reports that our country had a negative savings rate of -0.5% in 2005. And so far this year, this unfortunate trend seems to be holding.

In a growing economy, when times are supposedly good, this is absolutely unprecedented.

By contrast, Americans were fairly strong savers in almost every single year from the end of World War II through the middle of the 1980s. In 1985, the average U.S. citizen saved a respectable 11.1% of disposable income. No more! So why are people continuing to spend? Probably because of the gains they have in their homes, stocks, and bonds. Of course, those gains are unpredictable. Anyone counting on them is failing to see the impact that losses can have. Meanwhile, people feel wealthier simply because their assets have risen in value. This powerful force is known as the wealth effect. The general sentiment is, “Never mind that it might not last, I’m worth a million bucks right now.” With the wealth effect, comes a propensity to save less in other places. This is why, even if you look at other measures of savings, you’ll see a negative trend. For example, a study conducted by the Spectrem Group, a research firm, found that participation in company 401(k) retirement plans fell from 80% in 1999 to 70% in 2005. In addition, the average contribution rate fell from 8.9% in 1999 to 6.9% last year. And there’s another, even more dangerous aspect to the wealth effect: It compels people to borrow more. And therein lies my biggest worry … According to the Federal Reserve, consumer borrowing rose at an annual rate of 5.7% in June, after a 3.3% increase in May. In dollar terms, consumers borrowed $10.27 billion more than they did last year. That’s a heck of a lot more than the $3.7 billion economists were expecting.

More troublesome – the faster-than-expected jump was mainly the result of more credit card debt. In June alone, borrowing on credit cards and other “revolving” debt rose at an annual rate of 9.8% … on the heels of an 11% gain in May. That’s over twice as fast as the entire economy’s growth! All this borrowing pushed total consumer credit to a record annual rate of $2.19 trillion. And this doesn’t even include mortgages or other real estate loans. Americans who refinance their mortgages will cash out $257 billion from their homes this year, according to mortgage lender Freddie Mac. That’s a whopping FIFTEEN times more than the refinancing cash-outs of just ten years ago! Even Freddie Mac’s chief economist, Frank Nothaft, was surprised: ”I would have thought the home equity extractions would have been much weaker now. " I would have thought so too, Frank. But you can never underestimate the allure of gourmet meals and designer handbags.

0 Comments:

Post a Comment

<< Home